-

TikTok’s ownership shift exposed platform risk

-

Uninstalls surged as creators built exit strategies

-

Regional censorship fractured global reach

-

Smart brands diversified beyond rented attention

TikTok’s ownership shift exposed platform risk

Uninstalls surged as creators built exit strategies

Regional censorship fractured global reach

Smart brands diversified beyond rented attention

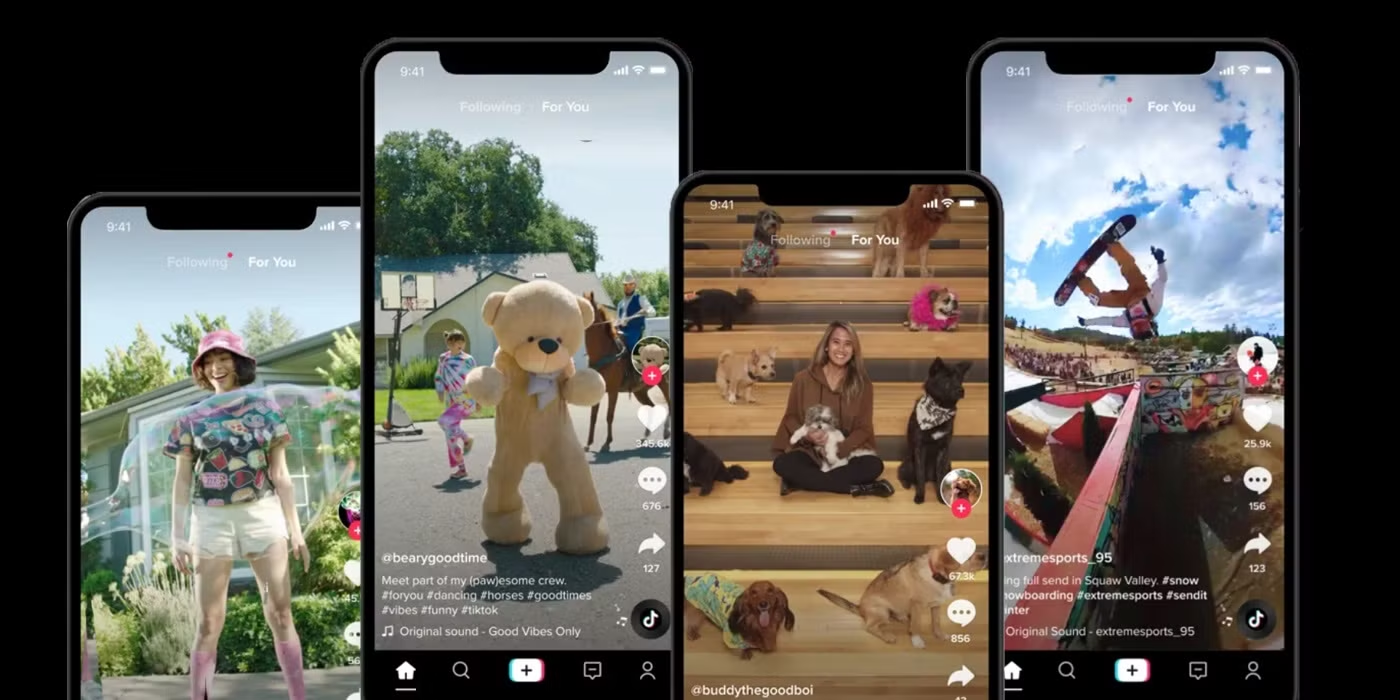

For the first time in years, TikTok isn't just changing. It's changing hands. And the brands and creators who built entire strategies around the platform are now asking a question they should've been asking all along: What happens when the ground beneath us shifts?

The answer came fast. Following the January 19th shutdown-then-reversal and the subsequent joint venture announcement with U.S. stakeholders, reports showed that TikTok app uninstalls surged by 150%. Creators scrambled to alternative platforms. Brands watched engagement fluctuate in real time. And the industry learned, once again, that building on rented land comes with risk, especially when the landlord changes overnight.

But this isn't just a story about geopolitics or app store drama. It's a story about what happens when brands mistake distribution for strategy, and what it takes to build influence that survives platform volatility.

Here’s the TL;DR:

TikTok's new ownership structure (a joint venture involving U.S. stakeholders and ByteDance's algorithmic infrastructure) resolved the immediate existential threat. The app is back. Creators can post again. Brands can run ads. On the surface, it looks like business as usual.

But that read misses the deeper shift happening beneath the surface. The new policies on TikTok shipping policies, content moderation, restrictions, and “safeguards” raises many questions about the platform's future.

Translation: The situation isn't over. It's merely evolved.

Brands and creators now face a different kind of uncertainty: not whether TikTok will exist, but whether it will function the same way.

Will content moderation tighten or loosen? Will the algorithm prioritize different signals? Will TikTok Shop's recent shift to centralized logistics change the dynamics of creator monetization? These aren't hypothetical concerns. They're active variables that could reshape the entire platform ecosystem in the coming months.

The brands treating this as a return to normal are missing the point entirely. The real lesson isn't that TikTok survived. It's that relying on any single platform as your primary growth engine is a strategic liability you can no longer afford.

Here's the uncomfortable reality nobody wants to say out loud: TikTok might not survive this.

Not because of regulatory pressure or geopolitical maneuvering, but because of something far more damaging: user abandonment.

“Now, the real question is whether the unfiltered info and organic creator reach that made TikTok culturally irreplaceable will survive American ownership prioritizing ‘safety and moderation.’ The algorithm retraining on US-only data will create some unpredictability, and there's a legitimate risk that heavier moderation could push TikTok closer to Instagram's over-curated, search-broken experience that killed what made social media valuable in the first place,” said Lauren Mabra, founder of Meta and TikTok creative agency Lauren Labeled.

The 150% spike in uninstalls it’s signal of change. And if there's one lesson the internet has taught us over the past few years, it's that platform dominance can evaporate faster than anyone expects. Just ask Twitter.

The parallels are striking. A platform experiencing mass migration. Users citing concerns about censorship and content moderation. Younger audiences leading the charge to alternatives. Competitors seeing massive install surges as disillusioned users seek new homes.

The difference is speed. When Twitter began its decline, the alternatives weren't ready. Mastodon was clunky. Threads didn't exist yet. Bluesky was invite-only. Users complained but mostly stayed because there was nowhere better to go.

Since then the trend has continued, and users have moved away from the app (with new environments like Threads stepping in as an alternative.)

TikTok has a real hurdle to face this time around. Instagram Reels is already built. YouTube Shorts has Google's infrastructure behind it. And Gen Z doesn't wait around. Platform loyalty isn't in their vocabulary. Cultural relevance is. And the moment TikTok stops feeling culturally relevant, they'll leave without looking back.

TikTok has a real hurdle to face this time around. Instagram Reels is already built. YouTube Shorts has Google's infrastructure behind it. And Gen Z doesn't wait around. Platform loyalty isn't in their vocabulary. Cultural relevance is. And the moment TikTok stops feeling culturally relevant, they'll leave without looking back.

The real danger for TikTok right now isn't just about users leaving. It's about what happens to the ones who stay.

The new terms and conditions aren't just legal boilerplate; they represent a fundamental shift in how the platform operates, who controls what users see, and what content gets suppressed. And early signals suggest the algorithmic changes are already happening.

Reports are emerging of significant content filtering between regions. Canadians aren't seeing U.S. content the way they used to. Americans aren't seeing Canadian content. The global version of TikTok that made the platform feel borderless and culturally unified is fragmenting into regional silos with different moderation standards, different algorithmic priorities, and different definitions of what content is "safe."

For brands, this isn't just a content distribution problem. It's an audience segmentation nightmare.

If you're a North American brand running a unified TikTok strategy, you may already be reaching a smaller, more fragmented audience than your metrics suggest. The Canadian followers who used to see your U.S.-based content? They might not anymore. The cross-border cultural moments that made TikTok feel like one big conversation may be replaced by algorithmically enforced regionalization.

And we're only seeing the beginning. As the platform adjusts to new ownership priorities and regulatory demands, the content moderation apparatus will likely tighten further. Words are reportedly being censored. Topics are being deprioritized. The algorithm that once rewarded rawness and authenticity is shifting toward something safer, more advertiser-friendly, and significantly less interesting.

This is how platforms die. Not with a bang, but with a slow, steady retreat from what made them matter in the first place.

“Brands and creators are understandably nervous: fewer users mean fewer eyeballs, and fewer eyeballs mean less attention. And in an ecosystem where every platform is competing for time and visibility, every day that TikTok stumbles widens the opening for Instagram and YouTube,” said creator economy expert Lia Haberman.

If brands are feeling the instability, creators are living it.

The shutdown period (even though it only lasted hours) sent a shockwave through the creator economy. Influencers who built their entire businesses on TikTok watched their livelihoods disappear overnight. Those with diversified income streams (YouTube, Substack, email lists, owned products) weathered the uncertainty. Those without them panicked.

Eco-travel creator Diamond Spratling felt the impact immediately, saying: "The current issues happening with TikTok have been very concerning, especially as a newer creator who was finally starting to get more traction and engagement. In just a span of two days, my views have gone down significantly, making it more difficult for people to learn about the content I share."

The aftermath revealed something uncomfortable: most creators don't actually own their audiences. They rent attention from platforms that can revoke access at any moment.

This isn't new information. Instagram's algorithm changes have been gutting organic reach for years. YouTube's demonetization waves have forced creators to build Patreon alternatives. Twitter's rebrand to X drove entire communities to migrate elsewhere. But TikTok's near-death experience made the lesson impossible to ignore.

The creators who will thrive in 2026 aren't the ones with the most followers. They're the ones building owned channels (email lists, Discord servers, independent websites, subscription products) that give them direct relationships with their audiences. They're treating platforms as distribution, not destinations.

Spratling's response reflects this shift: "I've been spending more time on Instagram and even YouTube the last couple of days," she said. That's not abandonment. That's adaptation.

Brands should be paying attention to this shift. The influencers you're partnering with today may not have the same reach tomorrow, not because they're less talented, but because the infrastructure they're building on is fundamentally unstable.

For creators who've built their platforms around social commentary, the uncertainty cuts deeper than metrics. Content creator Kimanie Travoy puts it bluntly: "The censorship coupled with questionable algorithm choices have been a deterrent."

Spratling echoes this anxiety from a different angle. "As a content creator who often speaks on social and racial justice issues, this is especially concerning as I'm worried that my voice and others alike will now be silenced," she said. "I came across a video the other day that revealed the new owners of TikTok and another video naming specific words that now seem to be censored."

This matters for brands in ways that go beyond engagement metrics. The creators who drive authentic cultural conversations are the ones feeling most vulnerable right now. If the platform's moderation priorities shift to satisfy U.S. regulatory concerns or advertiser sensitivities, the very voices that made TikTok culturally relevant could be the first casualties.

“Right now, the biggest issue isn’t that there have been hiccups—it’s the silence,” said Haberman. “The lack of visible communication from TikTok or anyone publicly associated with the company, including global CEO Shou Chew, is doing real damage.”

Brands partnering with creators need to ask: what happens to your influencer strategy when the creators who actually move culture can't speak freely?

When industry experts say "diversify," most brands hear "post the same content everywhere." That's not diversification. That's just cross-posting.

Real diversification means understanding that each platform rewards different content, serves different audiences, and offers different strategic value. YouTube Shorts, Instagram Reels, and TikTok might all be short-form videos, but they're not interchangeable.

YouTube Shorts integrates with long-form content ecosystems and Google search. Reels benefit from Instagram's social graph and shopping features. TikTok's algorithm prioritizes virality and cultural moment-capture in ways the others don't.

A diversified strategy doesn't mean doing the same thing three times. It means building a content system that treats each platform as a unique asset with distinct advantages and making sure that if any one platform disappeared tomorrow, your brand wouldn't disappear with it.

Eric Zaworski, a media marketing expert, frames it clearly: "Diversification across platforms matters deeply in 2026, and any brand treating TikTok as their number one growth channel needs to be baking redundancy into YouTube Shorts, IG Reels, and especially owned channels. The best thing brands can do right now is internally re-orient their POV on TikTok now, so that if things do deteriorate, you have flexibility to adjust."

That last part is critical. The time to diversify isn't when the crisis hits. It's before anyone sees it coming.

As Zaworski advises, "The move is not to pause, but pressure-test your strategy against a potentially shifting moderation landscape, and track changes now so you have a baseline if things change over time."

The current situation with TikTok is a perfect example of how social platforms (and mass sentiment about them) are a larger indicator of culture at large, and that brands need to be paying close attention.

Julia Dunfrund, Social Media and Corporate Communications at The Shark Group, sees it clearly: "The shifts in TikTok's North American ecosystem are reinforcing that real engagement, not raw views, is the clearest signal of cultural relevance. Everyday users have become the loudest force on the platform, shaping what feels believable, shareable, and worth attention, which makes TikTok less a marketing channel and more a cultural barometer."

Read that again. TikTok is a cultural barometer, not a marketing channel.

That distinction matters. Marketing channels are about reach, frequency, and conversion. Cultural barometers are about understanding what resonates, what's shifting, and where attention is actually flowing. The brands still treating TikTok as a place to push messaging are missing what makes the platform valuable in the first place.

The content that performs now isn't the most polished or the most produced. It's the most real. User-generated content outperforms brand content. Everyday creators outperform celebrities. Authenticity (even when it's imperfect) beats production value every time.

As Dunfrund puts it: "In this moment, relevance is earned through fluency and trust, not production value. In other words, the future of TikTok belongs to those who listen as closely as they post."

That's not a TikTok trend. That's the future of how communities form and brands earn relevance across every platform. The ownership chaos just made it more obvious.

The smartest brands in this moment aren't panicking. They're recalibrating.

They're auditing their platform mix to ensure no single channel represents more than 40% of their social traffic. They're investing in owned media (email, SMS, community platforms) so they control their audience relationships. They're building creator partnerships that extend beyond single-platform campaigns to multi-channel strategies with built-in redundancy.

They're also doing something more fundamental: they're changing how they think about TikTok.

Instead of viewing it as a growth engine, they're treating it as a listening tool. A place to understand what's resonating, what language people are using, what cultural moments matter. They're using TikTok to inform strategy, not to be the strategy.

This shift in perspective matters because it frees brands from platform dependence. If TikTok's algorithm changes tomorrow, these brands won't lose their entire strategy. They'll adjust their tactics while keeping their strategic foundation intact.

They're also investing in the infrastructure to move fast when things change. Not just monitoring tools, but decision-making frameworks that allow them to shift budgets, adjust messaging, and pivot tactics without waiting for quarterly planning cycles.

Dunfrund's insight cuts to the heart of what matters: "The opportunity lies in investing in partnerships and content that move at the speed of real behavior; reactive, imperfect, and community-driven, rather than chasing scale for its own sake."

That's not a prescription for TikTok. That's a prescription for modern marketing.

The future of community isn't broad reach and mass appeal. It's niche audiences, deep engagement, and trust-based relationships. It's creators who understand culture better than brands ever will. It's platforms as cultural infrastructure, not marketing channels.

TikTok's ownership crisis revealed which brands understood this and which ones were just renting influence they never really had. The question now isn't whether TikTok survives. It's whether your strategy can survive the next disruption, wherever it comes from.

Elevate your brand’s influence with award-winning, always-on marketing services.

.png?width=300&height=300&name=winter%20olympics%20(5).png)